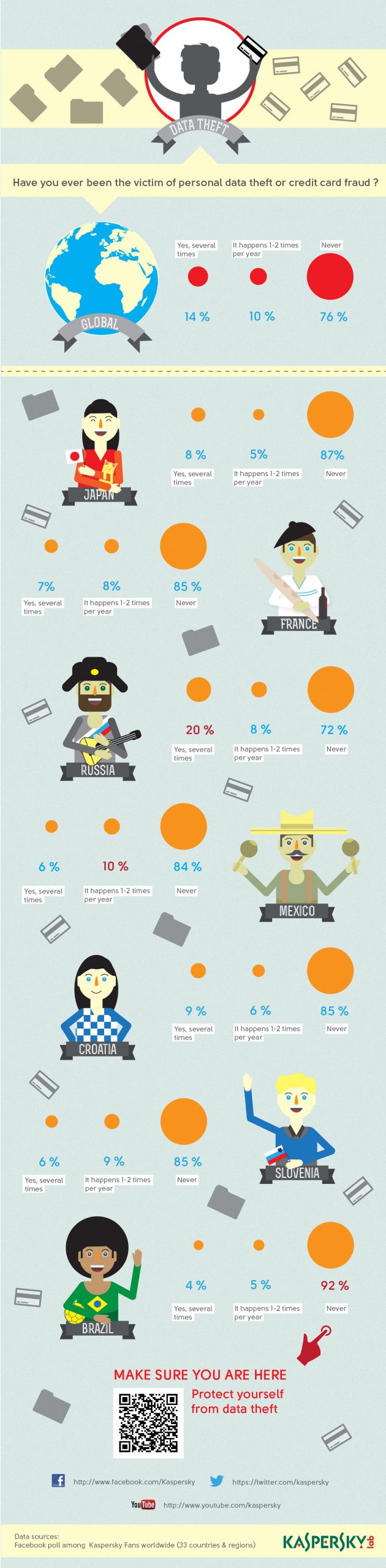

Unfortunately, data theft and credit card fraud have become common worries. We wanted to find out from our Facebook users if they have ever been targeted, so we asked if they have ever fallen victim to personal data theft or credit card fraud. While a majority of respondents have never experienced personal data theft or credit card fraud, on a global front, 10% of users are victims of data theft at least 1-2 times per year, 14% have been a victim several times and 76% have never been a victim.

Using strong passwords, not keeping credit card information on file and using a total security system are some of the ways to help prevent data theft and credit card fraud. Kaspersky PURE 3.0’s Safe Money technology, which uses a combination of digital security certificates and a real-time database that confirms the validity of a website’s reputation, ensures that any online transaction that requires banking, payment card or shopping information goes through safely. Safe Money will verify that a website is authentic and then present you with a secure web browser that keeps malware from infecting your machine and threatening your personal information or finances. It also includes a Secure Keyboard mode that engages when you enter your credentials online, surf to a banking website or enter payment card information, and prevents your keystrokes from being recorded by key-logging malware.

data theft

data theft

Tips

Tips